Welcome to Trades of the Week

This week we will discuss what is happening in the stock market and why cryptos are outrageously going to a new all-time high. Let’s have a look at all the profits we could earn this week.

BETZ

For Roundhill Sports Betting and iGaming, ETF we have a fantastic downward trend and are nearing break even at the present. So if you do your own research, it’s possible that it’ll go further down, but the other ones here or in a handful of other shorts, among others like SSP, have a nice downward trend as well. SSP was also stopped out of yesterday’s, resulting in a 1% loss on that trade. We’re waiting for this to move higher and take us in. Actually, the same can be said for SFT, which can range sideways as well.

Dropbox

In regards to Buffalo’s and Dropbox, we’re in a long position and currently in a good amount of profit, so we’ve now moved our stop loss up to 1%, which means if it drops down to our sort plus, we lock in at least 1% profit, which is great for us, so if it continues higher, we move our stop loss higher.

eBay

eBay has had a nice bullish move recently. We have now locked in a 5% profit, which is great and we are hoping, or not hoping, for it to push a little higher so we can lock in a little more profit with eBay, especially with Black Friday and Christmas just round the corner. We should see pushes in revenue as well which should move the stock higher.

Garmin

With Garmin, we’re increasing our stock plus 2% locking in 1%, and if it lowers down, we’ve made money. If it pushes higher, we can move our stop loss to lock in more gains.

Benefits for eBay, Dropbox and Garmin

We’re not just taking the profit; we’ve had a 1% loss. We’re locking in 1% at Dropbox, 5% at eBay, and another 1% at Garmin, for a total of 7% locking in because this might turn into 10/15/20 percent. eBay is a bit of a discovery mode at the moment, so you know next week it could be another 2/3/4 percent.

Golden Rule: Cut our losses short by allowing our profits to run up!

Big News: Earning season is coming up!

Be careful of who you trade with, especially with buffalo trading. Big giants like Apple, Amazon, and Microsoft are all reporting earnings this week, which could have a significant impact on the market. If all of the largest companies report negative earnings, we could see a negative impact or short in the market. However, the overall market appears to be bullish, as the SNP, NASDAQ, and Dow Jones are all attempting to reclaim all-time highs after the China dip.

Another bit of news that has come out is about Apple and their data sharing or data protection laws, and how they are limiting the amount of data that they share into the likes of Snapchat and Facebook, and how this could have a negative impact on Facebook’s revenue okay because by not allowing enough data from clients in who are using apple mobiles or apple products in Facebook, they will be limited to the ads that they are able to set out. This could be a downfall for Facebook.

ANM Healthcare Services

AMN Healthcare Services offers a good support level at the moment. We have seen these kinds of drops before back in November and February is another one we know. So now, we are waiting for consolidating or waiting for a break higher to enter. We have a nice three to one reward risk ratio on this.

Edgewell Personal Care

EPC is hovering around support and nice longer term support which looks excellent and we’re waiting for that to go higher as well. This will be very exciting to see through adding long today because the market looks really bullish.

Cryptos

If we move over to the crypto market, we can see that extreme greed is coming into play here and what has happened is people have started to pile in.

Bitcoin News: Bitcoin broke its all-time high record!

As the market gets greedier, be sure to take some profits which is what we have been doing. It did retrace a little bit and went down a little to retest the old level of resistance but now we’re continuing higher and we believe Bitcoin will go up to $200,000 per coin. But Bitcoin has been sleeping a bit lately, moving up and down a little bit when other coins have been booming. One of the reasons we’ve seen Bitcoin go up again is because Monster Card revealed that they had established a crypto integration for their consumers.

Solana

Solana is up another 200% since the last time we took profits. So we’re up another 200% this time. We also have Harmony, which is now creating NFT, which is a defiant platform that rates everything, which is a huge ecosystem of 300% and another 100%m so it’s a good time to move there as well.

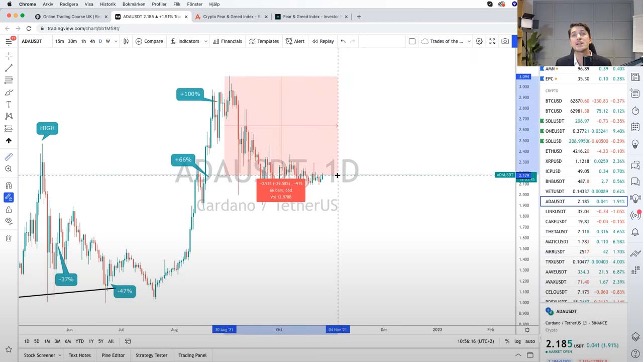

Cardano

There are a few cryptos that have’t changed much, one of which is Cardano. It is currently down by 29%, so you could use the ‘See Stay Technique’ to get into this.

Fantom

Fantom is being looked at, and it appears to be another one that is really going for it. It is likely to shoot up another 100% next week and profit will be taken.

GRT

GRT has already gone up 50% in the last two or three weeks, so we hope you guys are taking action and getting into some of these if you haven’t already. We went into axe Infinity last week as well, and we looked at polka dot as well, which appears to be breaking the higher so little trip doesn’t seem to be going for it so that’s it for the crypto.

PayPal

Paypal, right now, is about 20%, and we’re entering a second time which we consider to be a no brainer!

The latest trends in the crypto sector are determined by the endeavour to strike a balance between profit and loss when using cryptocurrency. What we are witnessing is something that sceptics said was impossible… until recently, when the financial world became multipolar. Regulators, traditional financial institutions, and crypto firms are increasingly partnering to maximise the benefits of crypto technology. The world both hopes and fears for the widespread adoption of it.

Are you a client of Investment Mastery? We would love to know the results you are making and have the opportunity to make you our ‘Client of the Week’! Send your results to gabriella@invesment-mastery.com, it would be a honour to feature you on our social media platforms where we can share your progress that will be a huge inspiration for others trading and investing.

Not much of a reader? No problem, watch the video below: