- Reading time: 8 mins 31 secs

Did you know…?

The first act of fraud ever recorded was perpetrated way back in 300 B.C. by a Greek merchant called Hegestratos.

Of course, this was in the days before money, but it makes us feel a whole lot better…because, even here at Investment Mastery, we have not been immune to such skulduggery!

But on a serious note, it turns out that many in our client community have been receiving requests for payment from accounts posing… as US!

How very dare they!

These imposters have been using social media to do their illicit phishing, and unfortunately, some of our lovely tribe have succumbed to the bait.

In fact, the scamming has been so intense recently we thought it important to inform everyone that this occurred so that firstly, you are all aware should you receive any requests and, more importantly, you IGNORE all such requests!

It is a doubly pertinent time to be mentioning it, as last week was International Fraud Awareness Week!

And as you no doubt recall, even the likes of powerhouse corporations such as Google and Facebook, not to mention big banks like HSBC, have all been subject to hacking in recent times, even as earlier this year.

In other words, fraud, scams, hackers, they are RAMPANT!

NOW… what we want everyone to know is, so that NO ONE falls for it in the future, is that our beloved founder Marcus DOESN’T USE SOCIAL MEDIA!

Let’s repeat that –

MARCUS DOESN’T USE SOCIAL MEDIA!

So… that means, if you receive anything via social media purporting to be from Marcus, YOU NOW KNOW it is a SCAM, FRAUD.

So IGNORE it or better still, inform us so that we can take them down, because, yeah, that is what we do as part of our security… take them down! Kick them out!

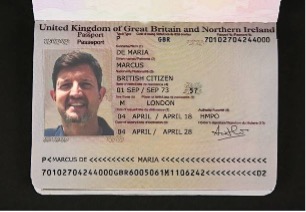

Another thing to remember, Marcus would NEVER send a passport image to clients to prove who he is…

This, in other words, is an out-and-out FAKE!

BUT it does show the extent to which these scammers and fraudsters will go to try and convince their would-be prey that they are actually communicating with the founder of Investment Mastery.

It’s kind of clever in a way, a newbie suddenly finds themselves speaking with the CEO himself and is so “overwhelmed” and caught up in the moment, that they don’t stop to question whether it’s really him!

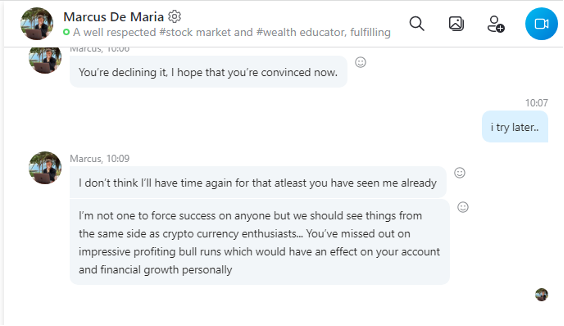

But then the next phase should really set the alarm bells ringing – how the pseudo-Marcus speaks, the words he/she uses in texts and emails – i.e. if the spelling is a bit suspect, it won’t be Marcus! He is a stickler for good writing and English.

Another sign this might be a doppelganger? The imposter Marcus may come across as trying too hard to get you to part with your money.

Also… please note, we NEVER ask for, nor TAKE, money via social media platforms.

We only ever act through the proper, secure, finance collection methods and processes provided by FCA-recognised means and instruments.

You might also like to know that, here at Investment Mastery, we take fraud EXTREMELY seriously and act immediately whenever fraud is detected, as well as regularly update our staff on fraud issues and training.

While on the theme of scams and frauds, here’s a quick round-up of the sort of thing that is going on right now that you might like to be aware of.

SCAMS & FRAUDS IN 2021

According to data, fraud amounted to a staggering £753.9 million in the first half of this year (2021).

Something called ‘push payment fraud’ netted criminals £355.3 million.

These scams involve the fraudster getting in touch with you via phone, email or text trying various ways to persuade you to hand over money.

Impersonation fraud is up nearly 130% in just 12 months… (Marcus should can get about!)

These types of scams are known as ‘social engineering.’ It’s where the fraudster tries to convince you that something is wrong and that handing over your money is the best course of action.

You may have seen these ones, where they try to pass themselves off as your bank or some other organisation, a utility company perhaps by copy pasting the official phone numbers and addresses.

They may even set up fake websites. But again, these might actually be obvious rip offs. You can spot a fake website if the images used look ever so slightly fuzzy round the edges, like poor copy-pasting used to be.

Investment scams have resulted in losses totalling nearly £108 million. The perpetrators of these pretty much always promise high returns.

Crypto’s have also felt the brunt of fraudulent activity, amounting to £146 million, up 30% on last year.

A whopping, £20,500 was the amount lost on average per person.

Of course, you may have heard of The Squid Game token debacle! Believe it or not, people thought they were buying a genuine coin. Trouble is, once bought, the owner could not sell on their coin. People were aware of that before buying in… so imagine their horror when the website suddenly folded and the coin became worthless, netting the scammers a tasty £2.5 million!

There’s more… but you should be getting the picture by now… SCAMS are rife and you need to be alert, on guard, ready to protect yourself.

So, in the spirit of awareness in the wake of International Fraud Awareness Week, we have put together our own little bite-size guide on how to avoid the scammers and fraudster.

Please take a look and take note.

7 STEPS TO PERSONAL SCAM PROTECTION!

1. LEGITIMATE COMPANY WEBSITE

It’s an old adage, but basically, if a company is making outrageous claims or guaranteeing success then, yep you guessed it… it’s too good to be true!

No, really, you should ignore it right away. The red flag should be popping up immediately! You should be thinking SCAM within a nanosecond!

The key to any company and website is VERIFICATION.

Verification is everything, so put your detective hat on.

Check their website thoroughly. If you have trouble logging onto it, maybe it comes up with a warning, then that’s not a good start!

If it is accessible, check the founders/directors of the company and their team, if they have one.

The CEO or Director or Senior Management should, in this day and age, have a LinkedIn page. Is there a photo of them? No? That’s possibly suspect.

If in doubt, double-check the key personnel of the company by running a quick internet search. If their name pops up on various platforms, great.

Can’t find a thing… hmmm, that isn’t good.

Scrutinise every word – is it a badly presented site? Cheap-looking, as if homemade?

Is the content clear and understandable… or lots of gobbledy-gook? Anyone purporting to be a reputable financial institution or broker who is trying to seduce you will have a professional website, not some cheap and nasty off the peg one.

Any reviews of the company?

Get the inside story from people who have had dealings with them.

Double-check contact details! No email address? Dodgy!

2. “GUARANTEED” PROFITS

Ah! Now. This cannot be overstated. That word “GUARANTEED”? It’s another HUMONGOUS RED FLAG!

Why?

Because finance regulatory bodies do not like companies guaranteeing anything.

Therefore, if they are a legitimate business, they will not be guaranteeing ANYTHING in the first place, simply because there are NEVER any guarantees in the world of investing and trading… that’s simply the nature of the beautiful beast!

Let’s face it, when have we ever guaranteed anything here at Investment Mastery? NEVER.

Besides, making a guarantee usually puts the hoodoo on it straight away!

3. SPELLING OR GRAMMAR ERRORS

This is a very quick and easy way to spot scams.

Basically, it’s all in the spelling… or not! Spelling or grammar mistakes are a HUGE give-away.

Three or more typos or grammar bloopers on a website? Alarm bells should be ringing! Avoid. DO NOT SEND THEM MONEY!

Also, as mentioned above, look out for copy/pasted chunks of text or statements from legitimate organisations that are being used to convey authenticity.

Basically, anything that LOOKS suspicious IS.

And any written correspondence you may receive purporting to be from a legitimate authority or organisation, would normally be signed off with a signature of the person writing to you.

No signature? Well, that probably means FAKE correspondence.

4. DO YOUR RESEARCH

Research?

Yes.

Because it will save you a WHOLE HEAP of financial woe!

Things to do?

Check the company is registered with business authorities such as Companies House.

Click the following link to access Companies House: https://www.gov.uk/government/organisations/companies-house

Check a company’s previous 12 month’s results.

Try searching on the internet for past historical cases that may involve the company.

A company or individual may be legitimately operating today, but maybe they have a track record of past misdeeds under a different name.

A simple search of something like “Smith & Jones banana controversies” might throw up some interesting information.

The #1 thing to remember is – NEVER give a company the time of day if they contact YOU asking for money!

5. SOCIAL PROOF

Testimonials!

Everybody loves them (including us!) Videos are best because they are from the customer themselves. They are putting their necks on the line, so are hardly going to say anything that might land them in trouble.

Check sites such as TrustPilot for other honest ones too, as people do post negative reviews, as well as good, which helps paint an overall picture. To be fair, negative ones can be a bit petty, it might be a case of a “bad day at the office” but at least it is visible and there for you to form your own opinion.

Once upon a time, companies would hire ghostwriters to write fictitious reviews, but that was clamped down on long ago and is now illegal under the Consumer Protection from Unfair Trading Regulations 2008.

In a nutshell, if you’re interested in a company that has ONLY positive reviews that would be too good to be true, right?

6. ENSURE THE COMPANY IS REGULATED BY A LEGITIMATE REGULATORY BODY

Saving the best till last – the real clincher in testing whether you are being scammed or not is to always ask yourself “is the company regulated.”

All companies taking money from you need to be authenticated by a regulatory body.

That’s because, quite simply, only regulated firms are allowed to provide investment services.

If a company isn’t regulated, it isn’t allowed to offer investment services.

This is important to remember because if you do hook up with an unregulated company, not only do you run the risk of losing all your money to the fraud, you won’t be able to claim that lost money back through any complaints procedure.

In the UK, the only regulatory body is the Financial Conduct Authority (FCA). Other countries have similar bodies.

The company you are interested in should have a number.

If the company’s name, or number, DOESN’T come up, STEP AWAY NOW!

This leads nicely on to..

7. CHECK THE COMPANY IS REGISTERED

If the company has authorisation from a regulatory body, then it should be on the national register of regulated companies.

So, if it is claiming to be regulated, always check if the company has a registration number to go with it.

This would normally be displayed on the supposed firm’s website, along with their VAT number.

Use this number to check the Companies House website of whichever country they are registered with.

You can check it at the Financial Conduct Authority, too, here: https://register.fca.org.uk/s/

It’s there? Great.

It’s not… MASSIVE red flag!

DO NOT INVEST!

At the end of the day – it’s YOUR money. You need to take care of it, not be handing it out to random faceless guys on the internet! Yes, some of these sites appear legitimate and authentic and convincing… but you still need to check them out. Better still, seek professional advice if you are really tempted and can’t convince YOURSELF to walk away.

Get someone to do it for you.

Thank you for reading and keep safe!

Not much of a reader? No problem, watch the video below: