- Reading time: 8 mins 40 secs

The What, When & How of Cryptocurrency

Cryptocurrency is a simple, interesting concept to signify digital money that anybody can send and receive without the involvement of banks or governments as an intermediary. Transactions are carried out and recorded on a decentralised ledger stored on computers worldwide.

Because cryptocurrencies are still a relatively new technology, they are primarily famous among early adopters. However, recent developments are allowing us to enter a new exciting phase of global mass adoption. Leading exchanges, custodians, wallets, and crypto platforms push the boundaries to make engaging and producing wealth easier for everyone. It’s a watershed moment for a vibrant ecosystem of financial infrastructure, which has the potential to reinvigorate current legacy payment and financial systems. It has also triggered a new wave of capital investment and the adoption of these systems.

What is 'Cryptocurrency Trading' and How Does It Work?

Let us first define the term “trading” before moving on to cryptocurrency trading. Trading can be described as the practice of purchasing and selling assets for a profit. Goods and services are examples of assets that can be exchanged between trading parties. We’re talking about financial markets, which are where financial instruments are traded. Stocks, money, cryptocurrencies, margin goods, and so on are examples of financial markets. Trading is typically thought of as a short-term endeavour; nevertheless, many people are misled by this notion. Cryptocurrency trading is the practice of purchasing and selling money or assets digitally, without the involvement of banks or the government.

Our curso de criptomonedas educates you and helps you to learn crypto trading through practical and mind-gripping examples. Our experienced professionals take you through this journey of managing finances efficiently and earning profits through cryptocurrencies.

Each cryptocurrency is a microcosm of culture, complete with memes, aesthetics, terminology, trusted voices, and power structure. Purchasing one is more than just a financial investment; it’s also a statement of self-identity.

BECOME FINANCIALLY

INDEPENDENT TODAY

Distinction Between Investing and Trading

Investing differs from trading – trading focuses on earning profits faster, whereas investment focuses on holding assets for the long term. We must look for long-term patterns and ignore short-term swings in the market while making any investment. Trading focuses more on short-term swings; therefore, understanding the daily market is necessary while trading to avoid risks or losses. At the end of the day, every human’s primary purpose is to earn money in the form of dollars or other currencies.

Every day, new coins are created, but only a tiny percentage of them survive. The products that offer the best technology or solve a complex challenge are sometimes the winners. At Dominio de la inversión, we teach you to both invest and trade cryptocurrencies at lower or no risk. How to safely invest or trade is a smart game that we help you to learn.

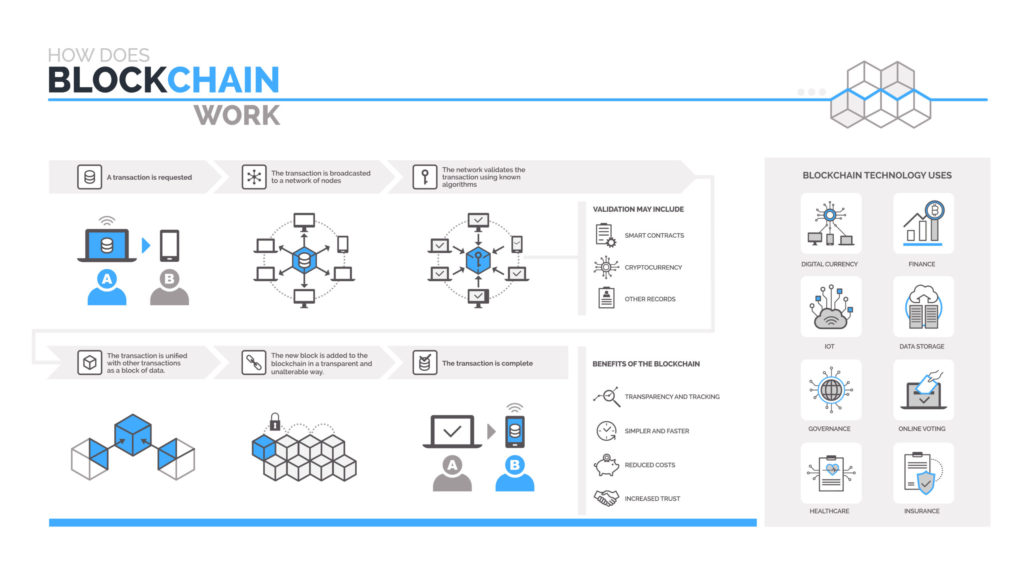

Concept of Blockchain

When the word “blockchain” is mentioned, most people’s eyes glaze over. It has already spawned entire industries—and entirely new ways to make money. Bitcoin proponents promote it as a store of value (“digital gold”), a medium of exchange (albeit less so presently due to volatility), and an inflation hedge. The primary purpose of Bitcoin investment is to obtain more coins. For example, if you buy four Bitcoins at a given price, the value of your entire asset will increase proportionally to the coin price after a few years.

There’s Bitcoin, Ethereum, Dogecoin, SafeMoon, Chainlink, Solana, Polkadot, Polygon, Cardano, and a whole lot more that define a blockchain. BTC is the abbreviation for Bitcoin. Bitcoin is the first widely used cryptocurrency, which is just another word for “digital money.”

In cryptocurrencies, confirmation is a crucial idea; only miners may confirm transactions. Blockchain miners accept transactions, verify their legitimacy, and broadcast them to the rest of the network. In conclusion, cryptocurrencies are part of a Blockchain-based ecosystem.

Blockchain is a technology that functions as a distributed ledger for the network and power Bitcoin. The network facilitates the exchange of value and information by providing a means of transaction. Cryptocurrencies are the tokens that are used to send value and pay for transactions on these networks. They can be thought of as Blockchain-based tools.

Five Key Components For Effecting Trading Strategy

An appropriate plan of action

The strategy is the long-term action plan you’ll be putting in place for dealing with Bitcoins. Several tiny techniques must be included in your Bitcoin trading strategy to be appropriate and acceptable for your trading strategy. It would help if you decided whether to use the hedging or holding strategy. In some situations, holding is the best option, while in others, hedging is the best option. With these considerations in mind, it will be simple to devise a plan that will enable you to profit handsomely from Bitcoin trading.

Goals for each day

No one who has been a Bitcoin trader for a long time will join the market without a daily goal in mind. When working with Bitcoins, you don’t need to have a long-term plan but set specific goals. It’s important to remember that the purpose of trading is to create little profits from daily transactions. It would be best to understand that Bitcoin trading will not make you a millionaire on your first trading day, so set small daily goals for yourself.

Wallet and exchange

Two of the most critical components to include in your Bitcoin trading plan are exchange and wallet. There are numerous cryptocurrency exchanges and wallets available on the internet; however, you must select the finest one. For purchasing the best wallet, several essential things must be considered: reputation, services, after-sale services, and many more.

Financial Risks

Anonymity is a good thing. Purchasing goods and services with cryptocurrency is done online and does not require disclosing one’s personal information. With growing concerns about identity theft and privacy, cryptocurrencies may provide users with some privacy benefits. For identifying users or customers, many exchanges use different Know-Your-Customer (KYC) methods. The KYC process used by exchanges allows financial organisations to limit financial risk while preserving the anonymity of wallet owners.

Market Movements

Extreme swings in the market. Because of their high volatility, cryptocurrencies are prone to attracting speculative attention and investors. Intraday price changes can present traders with excellent profit chances, but they also carry a higher risk. 24-hour market. The cryptocurrency market, unlike the stock and commodity markets, is not physically transacted from a single location. Individuals can conduct cryptocurrency transactions in a variety of locations throughout the world.

Ways to Make Money Through Cryptocurrency

1. Invest in Blockchain trading companies

In the next several years, blockchain might become a key aspect of finance, technology, and a variety of other industries, or it could take much longer. As a result, it’s a good idea to concentrate on companies that will undoubtedly profit from the evolution of blockchain technology but will be fine even if their blockchain objectives fail. Hundreds of publicly traded companies use blockchain technology in their operations, provide clients with blockchain-related services, or participate in the crypto industry. Some companies are solely focused on blockchain technology and/or cryptocurrencies, while others are incorporating blockchain-related products and services into an already successful business model.

2. Invest in solid cryptos in big caps and small caps

A new cryptocurrency network could quickly rise through the ranks and overtake other platforms. Staying informed about market events is the best thing you can do as an investor.

3. Investing in ICO

The cryptocurrency industry’s equivalent of an initial public offering (IPO) is an initial coin offering (ICO) (IPO). An initial coin offering (ICO) is a way for a firm to raise funding to develop a new coin, app, or service. In exchange for their investment, interested investors can acquire a new cryptocurrency token developed by the firm. This token might be used to purchase a product or service from the firm, or it could simply represent an interest in the company or project.

4. Crypto staking

This is a method of securing a portion of one’s cryptocurrency in order to contribute to a blockchain network. This is beneficial to the network, and it also allows cryptocurrency holders to earn money from coins that are simply sitting in their wallets. Those who choose to participate in crypto staking must promise not to withdraw their cryptocurrencies until the end of the agreed-upon time period. This also aids the network in gaining some advantages.

How To Place a Trade Using PCA?

Principal Component Analysis (PCA) is a statistical method that uses an orthogonal transformation to convert a set of correlated variables into a set of uncorrelated components. The goal of PCA is to reduce the number of dimensions in the data while maintaining as much variation (information) as possible. Principal Component Analysis is a dimensionality reduction technique that, in essence, creates a new variable that contains the majority of the information in the original variable. Normalising the inputs are required before performing PCA which is what we teach in our course.

Using our Compound Interest Calculator will show you how you the potential gains available with our low-risk strategies we teach in our course. It is recognised and approved by almost every stock trading regulatory body for the investments.

Is Cryptocurrency the Best Investment Opportunity?

The accounts are comparable to stockbrokers in that they allow you to purchase and sell digital currencies such as Bitcoin, Ethereum, and Dogecoin. The best cryptocurrency exchanges make it simple to buy and sell the currencies you choose, with low fees and strong security measures.

It’s vital to consider supported currencies, pricing, withdrawal choices, and security when choosing the best cryptocurrency exchange for your needs, which is what we teach in our course while compiling this list of the best cryptocurrency exchanges.

How to Open a Broker Account?

Like any other asset, you can make money by buying cryptocurrency low and selling high or losing money in the inverse scenario.

Important Facts about Cryptocurrency Taught in our Course

- When it comes to cryptocurrency trading, remember that one of the essential things comprehends market movements to avoid significant losses. Because the crypto market is so volatile, it’s best to invest just what you can afford to lose, and if you’re a beginner, you should seek advice from a professional. Our course helps you to understand market movements for better decision-making.

- If you want to succeed in cryptocurrency trading, we teach you about market trends and short-term price trends. It’s more like buying low and selling high, and the patterns end up working to your advantage.

- Many considerations and particular measures must be followed when trading cryptocurrency like the concept of cryptocurrencies, crypto exchanges, cryptocurrency security, and all relevant terminologies.

- We teach you to monitor weekly and monthly price charts that will help you to assess market patterns.

- The truth about Bitcoin mining is that it has a purpose: it is Bitcoin’s backbone. Bitcoin is secured by mining. It protects your Bitcoin safe and valuable by preventing your Bitcoin wallet from being hacked. We teach you about this critical aspect in our course.

- Bitcoin mining is decentralised to much smaller computer clusters (often as tiny as one computer in a person’s house). Its future may be similar to those of equities, bonds, real estate, and the internet. Bitcoin has barely been around for ten years, and cryptocurrencies, in general, are even newer. However, through our course, we teach you to gradually make it a part of your daily life.

- An asset must be an “asset that can be saved, retrieved, and exchanged later, and reliably useful when retrieved” to be a store of value like gold. We teach you how to safeguard your assets through cryptocurrencies.

- Bitcoin may be on its way to becoming such a value store and its value has only increased over the years. Through our course, we teach you how Bitcoin can be kept, retrieved, and exchanged for years. Consider it in the same light like gold whereas gold isn’t available to everyone.

- We believe that maintaining a node should be simple, inexpensive, safe, and quick. In our course, we help developers and organisations to focus on what provides value to their client base while offering a secure, dependable service by removing the low-level responsibilities associated with node management. As a result, good node management is essential for a positive user experience.